Guides & Practical Insights

EAD/ABD, TARIC and HS Codes

The Export Accompanying Document (ABD/EAD) is the key customs proof for exports from the EU. TARIC (the EU’s integrated tariff) and international HS codes (Harmonized System) form the basis for correct classification — including preferences, duties and licensing requirements. We classify goods in a legally sound manner, assess benefits and set up robust SOPs for recurring shipments.

WCO (World Customs Organization)

The WCO defines global standards, data models and best practices for customs procedures. We help translate these requirements into practice — for example by harmonising datasets, preparing for audits and accelerating releases.

CCAM (China Customs Advanced Manifest)

For shipments to China, CCAM requires early electronic submission of detailed cargo information. We ensure your CCAM data is complete, accurate and submitted on time — to avoid delays and penalties and to keep goods flowing predictably.

Incoterms — Clarifying Responsibilities

Incoterms define obligations, costs and risks between buyer and seller. Clauses such as DDP (Delivered Duty Paid) or EXW (Ex Works) directly affect transport, insurance, customs handling and tax liabilities. We advise which clauses best fit your supply chain and how to minimise risks contractually and operationally.

KPBGS delivers measurable value: structure, transparency and legal certainty at every stage of international trade — from contract design and customs declarations to final delivery. Compliance becomes a competitive advantage.

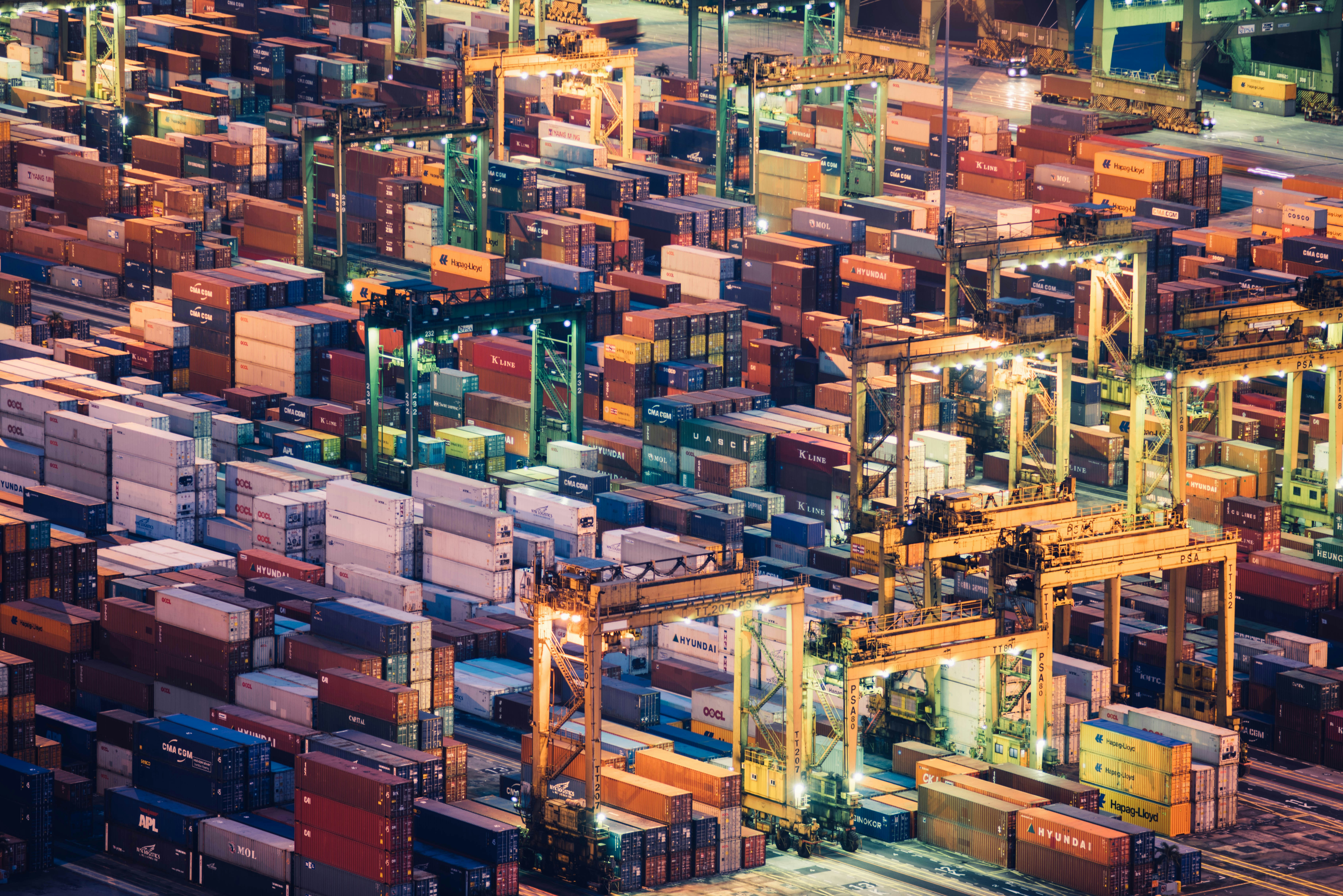

Global Logistics and International Connectivity

International supply chains are a competitive factor — while requirements for data quality, evidence and compliance continue to rise. KPBGS combines customs and legal expertise with operational execution: we structure master data, define clear ownership and establish robust SOPs so goods flow predictably and risks (e.g., misclassification, incorrect Incoterms, documentation gaps) are mitigated early. Compliance becomes a scalable lever — measurable, audit-ready and standardised for recurring shipments.

Deep-dives on Customs, Logistics & Trade Law

Entity Setup & Fiscal Representation

Registrations, Fiscal Representation, SOPs & Go-Live.

Open Guide

HS‑Code & TARIC

Classification, Preferences & Licensing.

Open Guide

ABD/EAD – Export Accompanying Document

ATLAS, Presentation and Proof of Export.

Open Guide

CCAM

Pre-Declaration, Data Quality, Deadline Control.

Open Guide

Incoterms & DDP

Risk, Cost, Tax Implications.

Open Guide

WCO – World Customs Organization

Standards, AEO, Data Harmonisation.

Open Guide